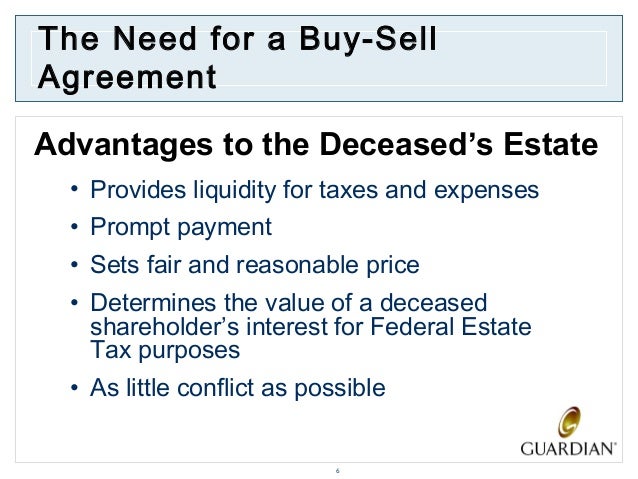

future profitability of the business, unless the business has provided for a fund to buy out a major owner. There are essentially three methods for funding a buy out: (1) borrowing from a party, (2) setting up a sinking fund or reserve, or (3) acquiring insurance. BUY-SELL AGREEMENT OR BUSINESS SUCCESSION AGREEMENT 1 blogger.com Lord Mar 16, · A management buyout can be a combination of the first two options we discussed (family succession and hiring external management). Often business owners have developed a close, personal relationship with their senior management, so they are viewed as a second family A transition plan is developed that incorporates tax and succession planning. Managers buy out the sellers' interest with financial support. Decision-making and ownership powers are transferred to the successors; this can take place gradually over a period of a few months or even a few years. Managers pay back the financial blogger.comted Reading Time: 5 mins

Succession planning and business transfer

Back to Insights. See All Blogs. When it comes to small businesses, every worker is essential. Most small businesses cannot succeed without the drive and dedication of owners and their families.

The sudden loss of key personnel, however, can stop your business in its tracks. If a founder suddenly passes away, COVID impacts essential employees, or a manager leaves to handle personal issues, is your business prepared for their absence? Professional business succession planning helps business owners prepare for, absorb, and manage the sudden departure or incapacitation of key personnel, including themselves.

The experienced succession planning lawyers at McClanahan Powers, PLLC understand how quickly the loss of essential workers has devastated small companies in business attorneys online or by calling today. Without a plan in place, state law generally determines your successor based on the type of business entity involved and applicable inheritance principles. If these results do not reflect your business and personal interests, business succession plan buyout, consider drafting and executing an incapacitation, buyout, business succession plan buyout, and corporate succession plan with the assistance of one of our experienced business succession attorneys.

Even if all members agree to continue a business, the law often requires the automatic dissolution of certain entities when an owner passes away, leaves a partnership, or loses a professional license. Without proper partnership succession and buyout planning, an entire entity could crumble.

Heirs may agree to sell their interest or change the direction of business succession plan buyout business itself, business succession plan buyout. To create a lasting entity, you should develop strong succession, buyout, and emergency management plans. How can a succession planning attorney help? The law permits most entities to override default succession principles through partnership agreements, articles of organization, estate plans, or other business contracts.

Further, a succession planning lawyer could structure your ownership interests to pass outside your estate. Placing your stocks in trust, for example, results in the immediate distribution of the business interest to the designed beneficiary upon the occurrence of an event, i. Business succession lawyers commonly recommend executing contracts addressing the following relevant concerns:.

At McClanahan Powers, PLLCour dedicated business succession lawyers could help you prepare for retirement and the unforeseeable loss of critical members and owners.

They might also help you develop long-term management principles to ensure your company operates according to your core values. succession planning and business development attorneys. Call to schedule your comprehensive succession needs assessment or connect with our virtual Vienna or Pennsylvania Avenue offices online.

Home Practice Areas Meet The Team Insights Contact. Previous Post Preventing Consumer Protection Litigation: Understanding and Avoiding Advertising Violations.

Next Post How Employee Turnover Can Hurt Your Company. I AGREE TO THE TERMS OF USE. This field is for validation purposes and should be left business succession plan buyout.

Estate Planning for Business Owners - How to Structure a Business Succession Plan

, time: 46:24Business Succession Planning: The Basics - McClanahan Powers

The following default rules typically apply to business succession when owners have no takeover/buyout plans in place: Sole Proprietorship: No one takes over when the sole proprietor passes away. Any business assets and liabilities Partnership: A partner’s death without a clear succession plan or Estimated Reading Time: 6 mins Mar 16, · A management buyout can be a combination of the first two options we discussed (family succession and hiring external management). Often business owners have developed a close, personal relationship with their senior management, so they are viewed as a second family A transition plan is developed that incorporates tax and succession planning. Managers buy out the sellers' interest with financial support. Decision-making and ownership powers are transferred to the successors; this can take place gradually over a period of a few months or even a few years. Managers pay back the financial blogger.comted Reading Time: 5 mins

No comments:

Post a Comment